Evaluate the risks and reliability of counterparties using indices and conclusions

Unique analytical indices help to assess the reliability of the counterparty, its financial stability and creditworthiness.

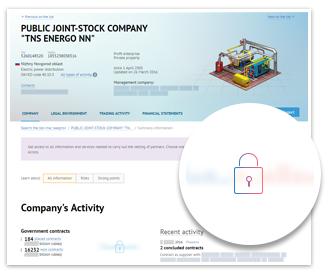

Subscription required

Hidden information is available only to subscribed users. Purchase a subscription to get full access to the service.

Buy

Subscription required

Available with the 1-month and 1-year subscription.

Unique analytical indices help to assess the reliability of the counterparty, its financial stability and creditworthiness.

Unique analytical indices help to assess the reliability of the counterparty, its financial stability and creditworthiness.

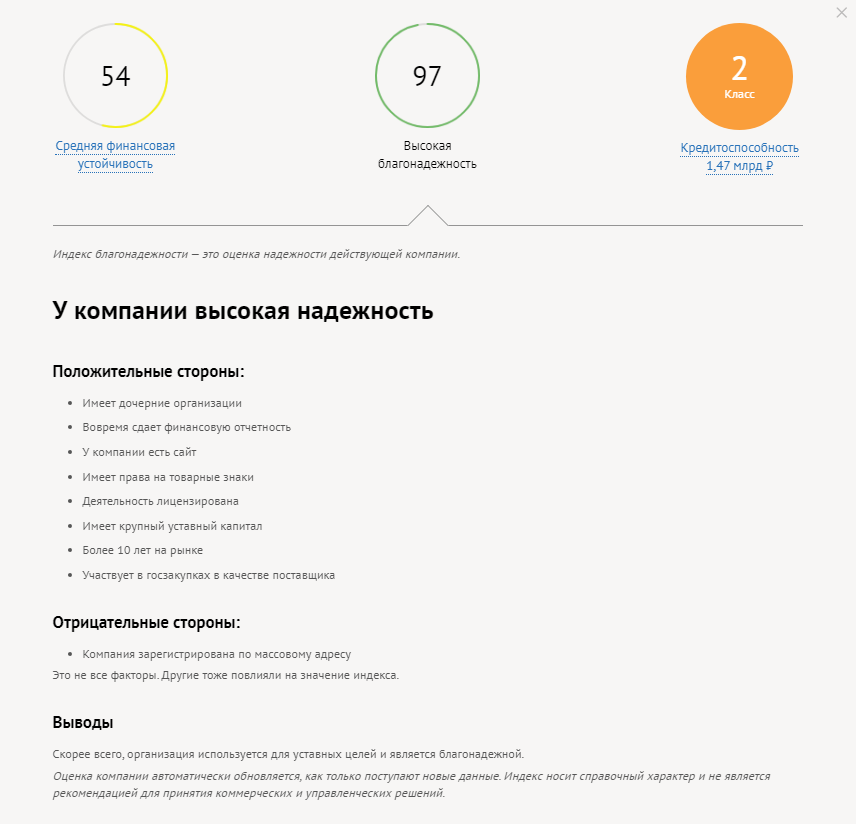

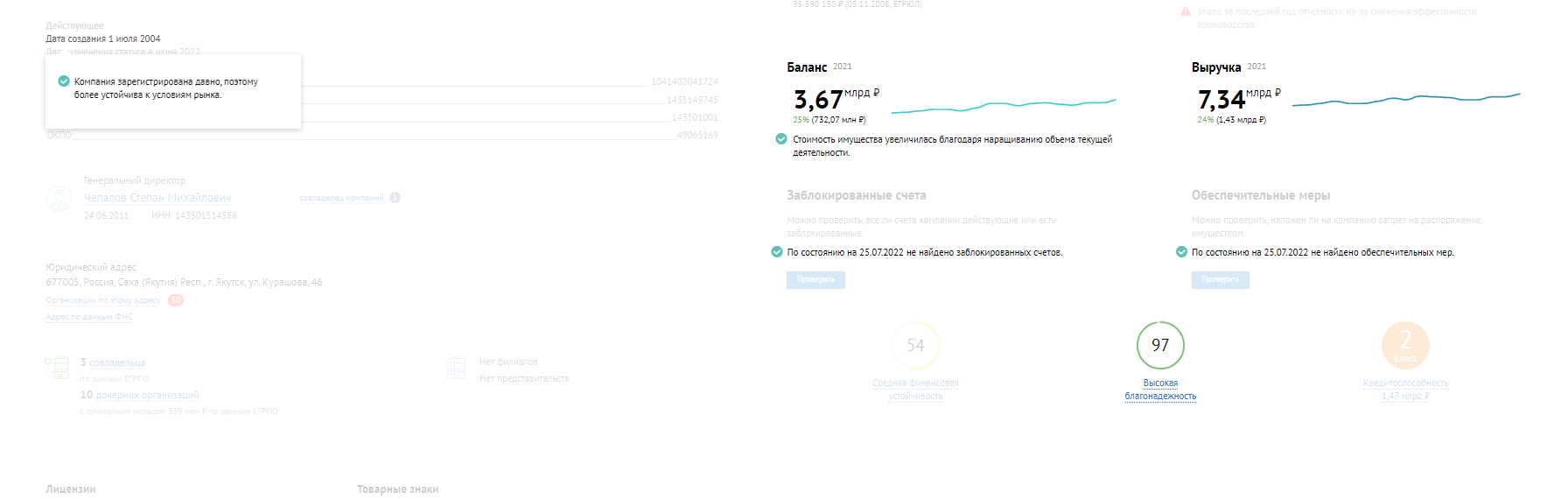

The higher a company's reliability score, the less likely it is to be a "fly-by-night" company created for the purpose of financial fraud. Evaluate the reliability of the counterparty using a unique scoring model, which takes into account about 30 indicators of financial, economic and legal activities of the company. The service will show the level of reliability, the level of reliability on the legality of the activity and business activity. Negative sides will indicate the risks of due diligence, which are defined in the letters of the Federal Tax Service. The conclusion will be a hint for choosing an in-depth inspection or signing a contract.

Reliability is determined by a 100-point scale:

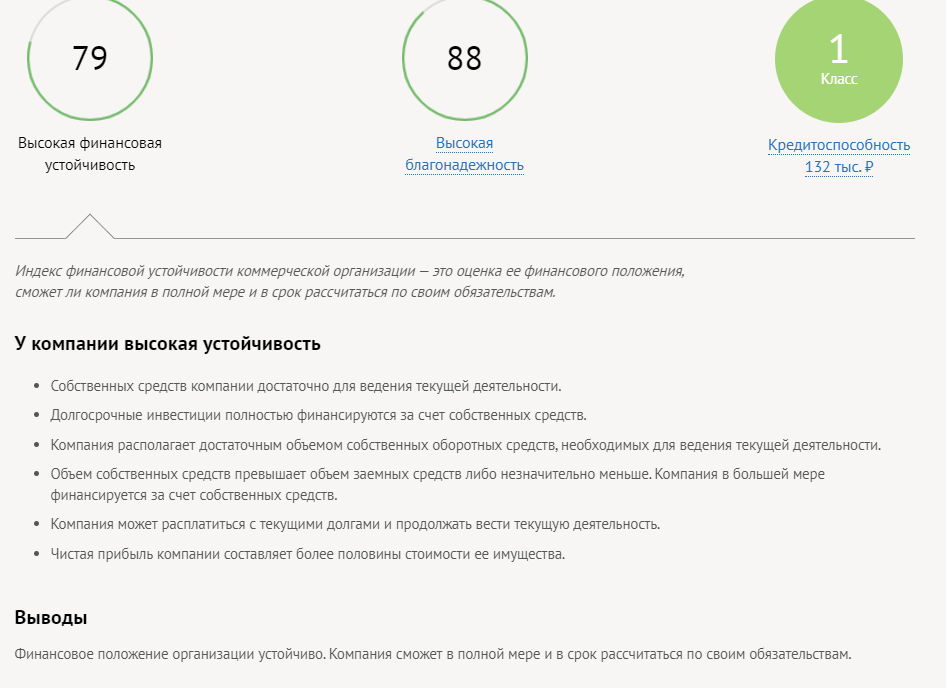

It helps to assess the financial situation of the company, whether the company can fully and timely pay its obligations, how strong is its dependence on borrowed funds.

The service analyzes the counterparty's financial structure and the company's dependence on creditors and investors (including the counterparty's working capital, long-term investments, borrowings and debts, liquidity ratios, financial independence and risk, company profits and many other indicators). Will show the value of financial stability: high, average, low or extremely low with detailed justification and conclusions.

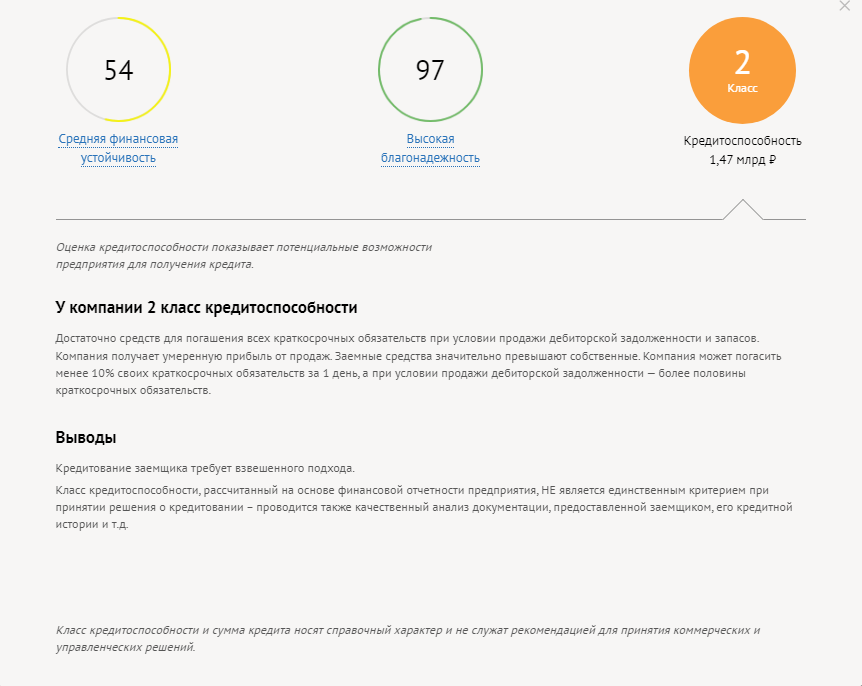

If you decide to make a deal with a counterparty who plans to take out a loan, you will know in advance whether it will be approved and for how much. The index is developed together with Seldon financial partners.

You can also check your own company for acceptable credit.

By analyzing all three indices, you can form a more complete and clear picture of the counterparty. For example, if reliability is high and financial strength is medium or low, then a detailed check of the financial statements can see that the client has increased fixed assets or used leasing, which may indicate his desire to develop the business.

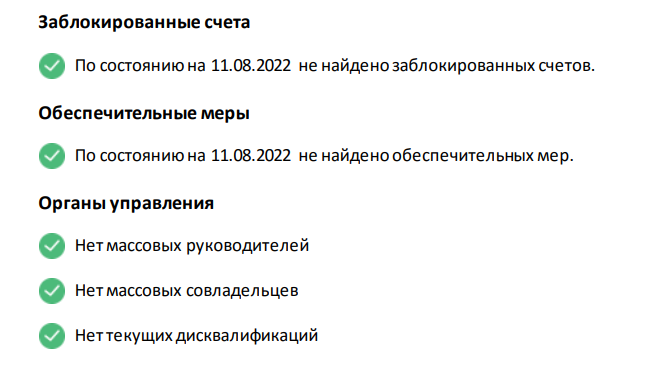

Also in the system on the summary page there are marker conclusions about the company's activity. They show the positive and negative facts of the company's activity. In particular, the conclusions will allow you to assess the company's strengths, such as revenue growth compared to the previous year or the absence of blocked accounts:

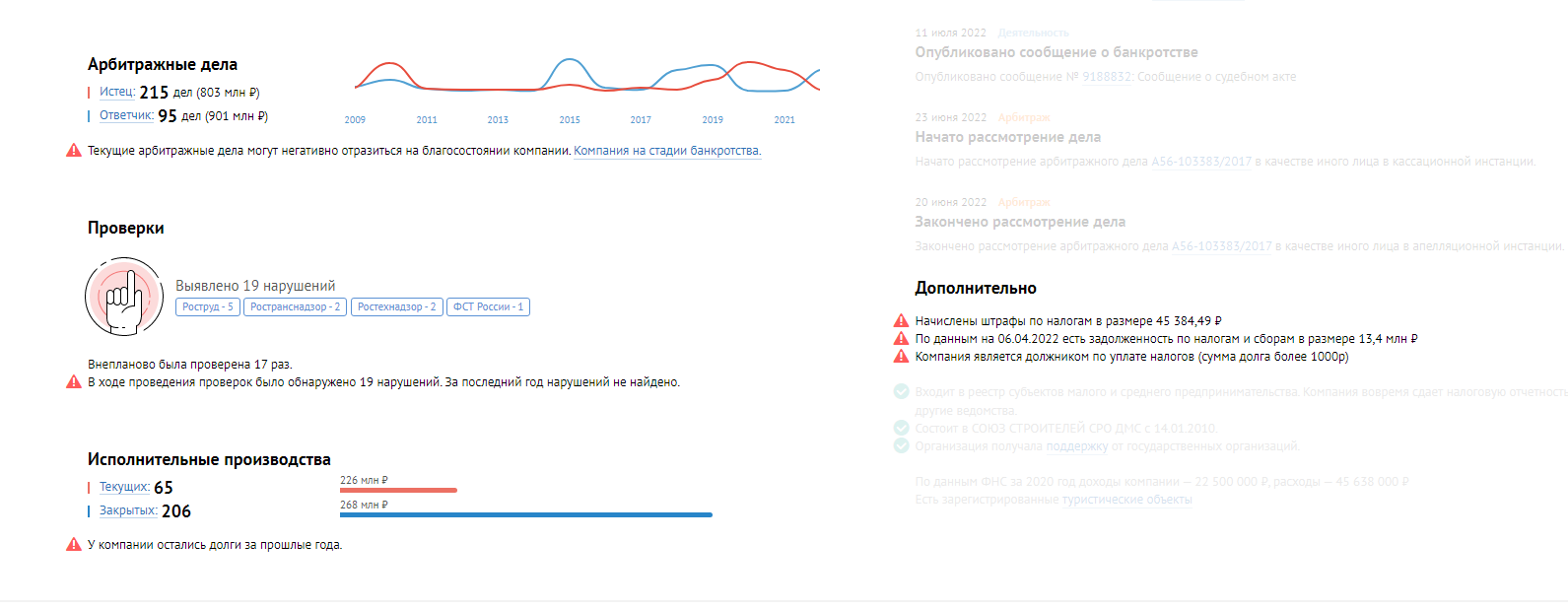

And you can see and examine the negative facts, the presence of which can mean significant risks when entering into transactions with such a counterparty. For example, the conduct of enforcement proceedings against the company, the presence of arrears of taxes and penalties on arrears:

At the top of the page are the Risks and Strengths buttons. They allow you to quickly highlight risk factors or strengths among the data on the summary page. In one click, you can get a visual summary of arbitration, enforcement proceedings, inspections, and additional information from negative registries.

Using the functionality in the header of the company card, you can get an "Express Check" document, which will have the result of checking the company for more than 150 conclusions. In addition to the parameters required for due diligence as recommended by the FTS, the system will also check the data on all available sections. The document can be used for a quick preliminary assessment of a counterparty.