Checking Accounts and Encumbrances

We continue to disclose the new features of Seldon.Basis in the information blogs.

Subscription required

Hidden information is available only to subscribed users. Purchase a subscription to get full access to the service.

Buy

Subscription required

Available with the 1-month and 1-year subscription.

We continue to disclose the new features of Seldon.Basis in the information blogs.

We continue to disclose the new features of Seldon.Basis in the information blogs.

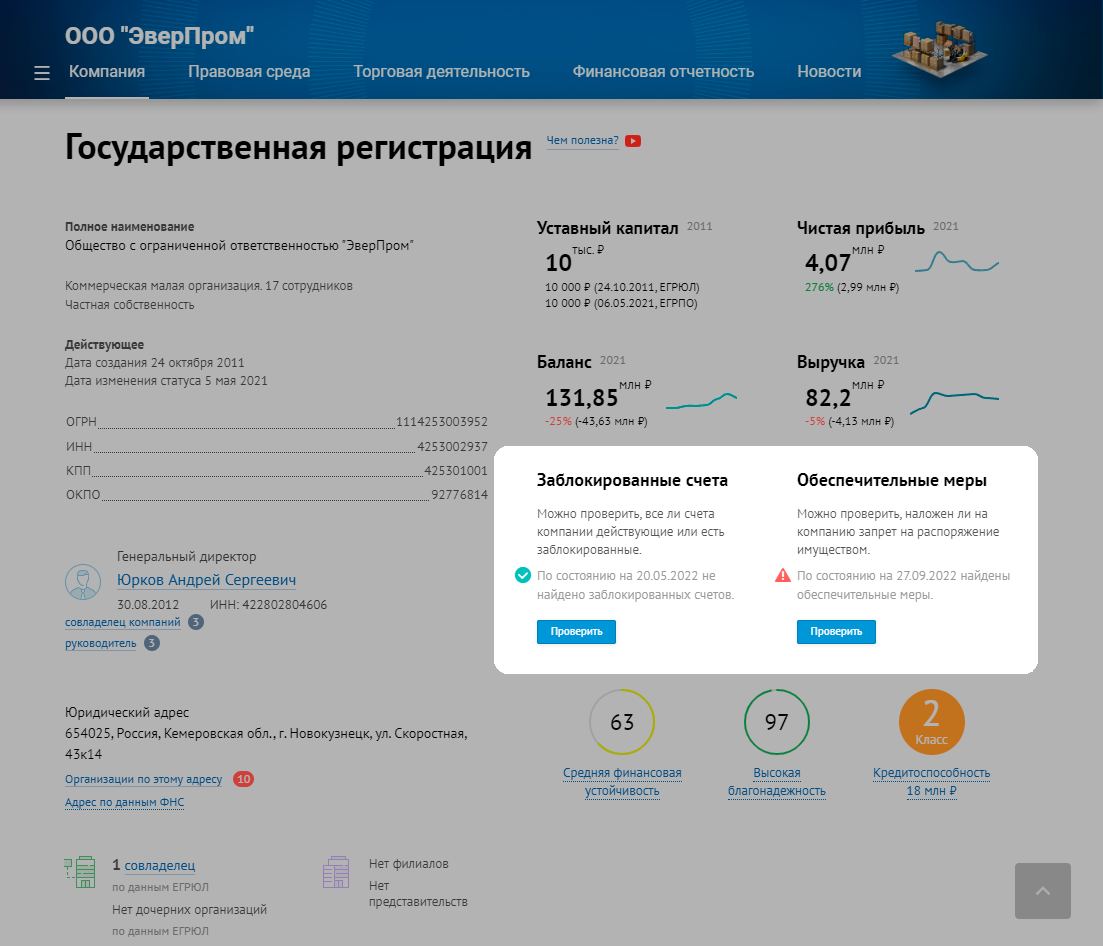

Read also about the importance of auditing financial statements of companies here.Check, before making agreements, whether all accounts of the company (proprietor) are valid or blocked.

The bank can stop the company's debit operations completely or partially. With a partial blocking, the proprietor cannot withdraw cash and, in some cases, loses access to the Internet Bank. If blocked completely, the proprietor cannot pay counterparties, withdraw money, or open a new account. Only mandatory payments can be made: taxes, salaries, alimony, insurance premiums, and fines. Banks block accounts on the basis of Federal Law No. 115 on Money Laundering and Terrorist Financing.

The tax service may block the accounts of a company (proprietor), for example, in case of failure to submit mandatory reporting or failure to comply with the rules of electronic interaction with the tax authority. Usually, even proprietors themselves remain unaware of blocked accounts in their company until the last moment. Therefore, it is important to check both their own company accounts and the accounts of current and new counterparties on an ongoing basis.

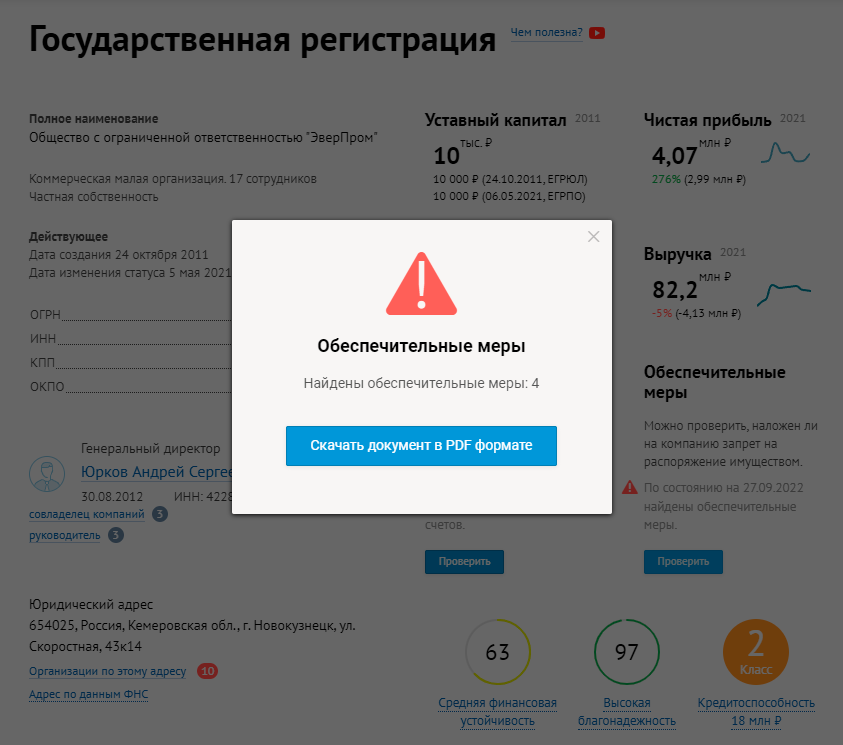

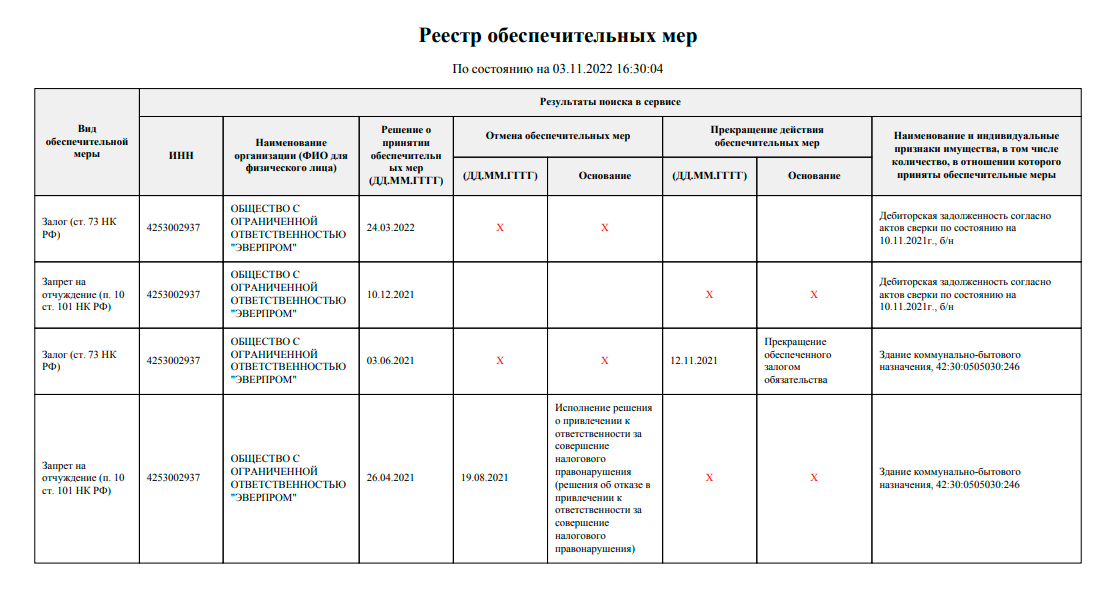

Check the interim measures imposed on the company's property.

Now the tax authority has the right to introduce interim measures only after the fact - by the results of an on-site audit of the debtor. This measure is used to combat evaders who have time to sell all their property, withdraw capital and go bankrupt. The frozen property is a security for the fulfillment of claims for creditors. You should not assume that this measure will not affect respectable taxpayers, because the tax authorities conduct field audits on the basis of their internal methods for calculating the tax burden.

As a security measure may be a pledge or a ban on alienation. At first, only the real estate may be frozen. If it does not exist, then vehicles, design objects on the premises and, lastly, "securities" can be blocked. There will be no impediment to the company's economic activity. There is a risk that banks will be reluctant to issue bank guarantees or open new lines of credit. There will also be serious reputational and economic risks. Counterparties, knowing about the possible disadvantage of a partner and the risk of default, may stop the shipment of goods or payment.

If you choose a new counterparty and discover the imposition of interim measures in a timely manner, you still have the option of choosing another partner. And if it is an existing partner, strengthen monitoring to determine the dynamics of changes and make the necessary decisions.

If such measures are found, you will be able to download a document with detailed information.